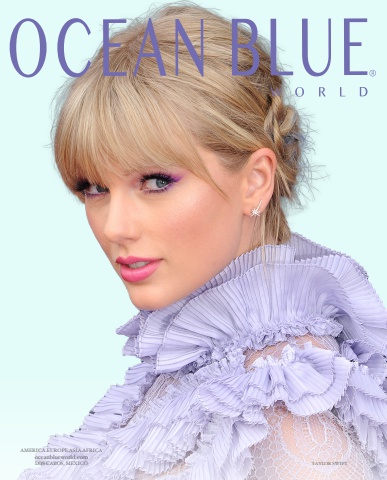

Art Investment – What Else?

By: Daniel J. Penseyres

Welcome to the “sub-zero-rate” world with its ZIRP, NIRP and QE. This means that bond yields are now negative in Switzerland, Germany, Finland, Netherlands, Austria, Belgium, Denmark, France, Ireland, Sweden, Italy and Spain.

So, irrespective of the credit quality of those borrowers, bond investors in all of those countries are guaranteed to lose money if they hold that short-term paper until it matures. Strangely, when asked about risks, these investors tend to remain on the conservative side and continue to fear the volatility of the equity, currency and commodity markets.

So wealthy individuals are asking their bankers: Should «Art» be considered for my portfolio?

The main characteristics usually used to define art markets can be summarized in the following way: high-risk investment, illiquid, opaque, unregulated, high transaction costs, at the mercy of erratic public taste and short-lived trends.

Artworks do not generate any cash flows that can be discounted, however, income can be obtained through lending, with expenses incurred for storage, insurance and associated costs. The art markets are also currently virtually ‘unhedgeable’.

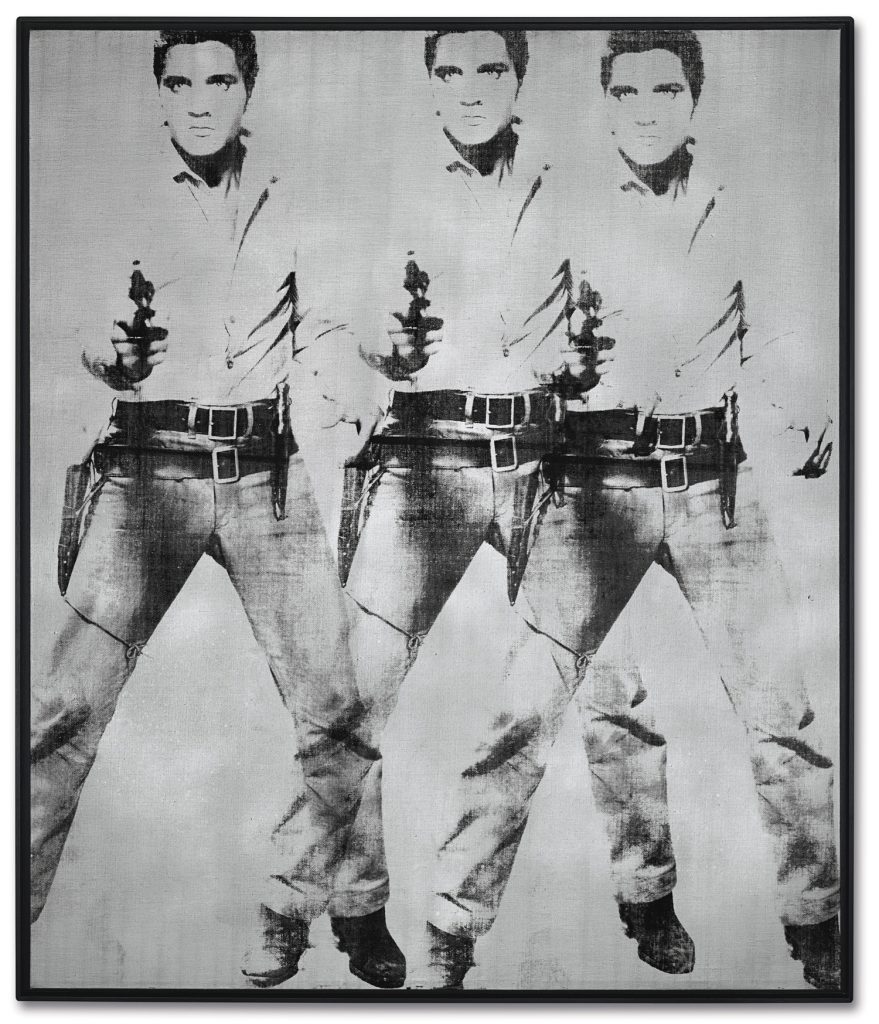

This short description of the art markets might be enough to discourage many. However, if we take a closer look at the latest trends, which are directly or indirectly, affecting the art markets’ they suggest the emergence of a financial fine art market where fine art is considered as a new asset class.

Some high net worth individuals view art as a pure financial investment and with the growing need to diversify portfolios, there should be space for more investment products that offer an indirect exposure to art and other collectible assets. For now, some of these individuals are enjoying valuable art either exposed in their living rooms or hidden in freeports.